Quantitative Modeling and Simulation

Engineering Models, Optimization, and Comparison of Algorithmic Trading

Independent research project modeling financial strategies with calculus-based signal generation and real-time performance benchmarking.

Project Details

This project investigates whether structured, engineering-based techniques can outperform passive benchmarks in algorithmic trading.

Research Objectives:

- Apply mathematical modeling and calculus to extract actionable structure from market data

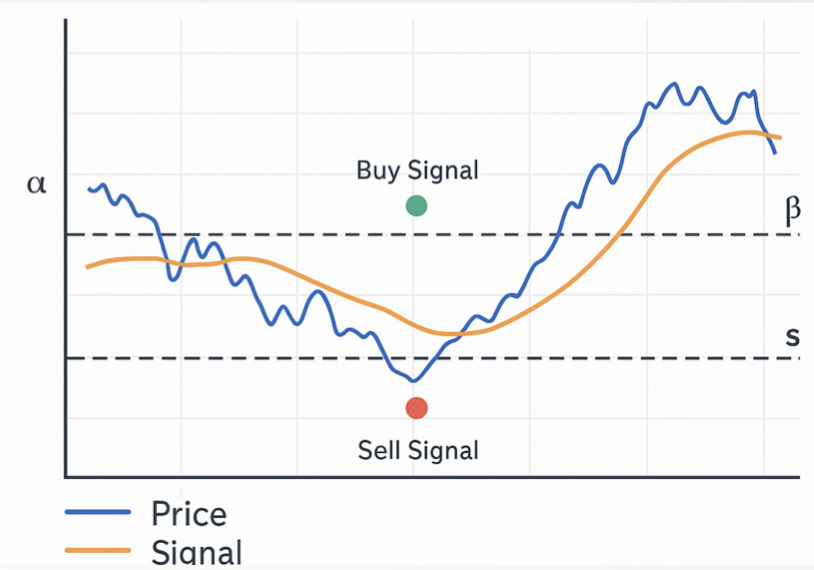

- Develop a signal generation system using slope and acceleration of price curves

- Optimize entry/exit thresholds for dynamic market regimes

- Benchmark performance against passive strategies like SPY and QQQ

- Uses Savitzky–Golay filters to smooth price curves while preserving turning points

- Computes first (slope) and second (curvature) derivatives to detect inflection trends

- Applies threshold logic to trigger trades based on derivative magnitude and direction

- Performs backtests with Sharpe ratio, drawdown, ROI, win rate, and trade count

- Benchmarked against SPY buy-and-hold to assess relative edge

- Real-time ticker selection and signal overlay via Streamlit

- Moving slope and acceleration visualizations

- Heatmap-based parameter optimization with adjustable entry/exit zones

- Walk-forward validation and fold-specific Sharpe analysis

- Trade log download and performance history export

Wind Turbine Impact Study: Monte Carlo Forecasting

Data-driven simulation assessing the impact of wind turbines on renewable energy capacity in the U.S. and Europe.

Project Details

Built as part of the Data-Driven Decisions course, this project evaluates the variability and potential of wind energy using Monte Carlo simulation.

Study Goals:

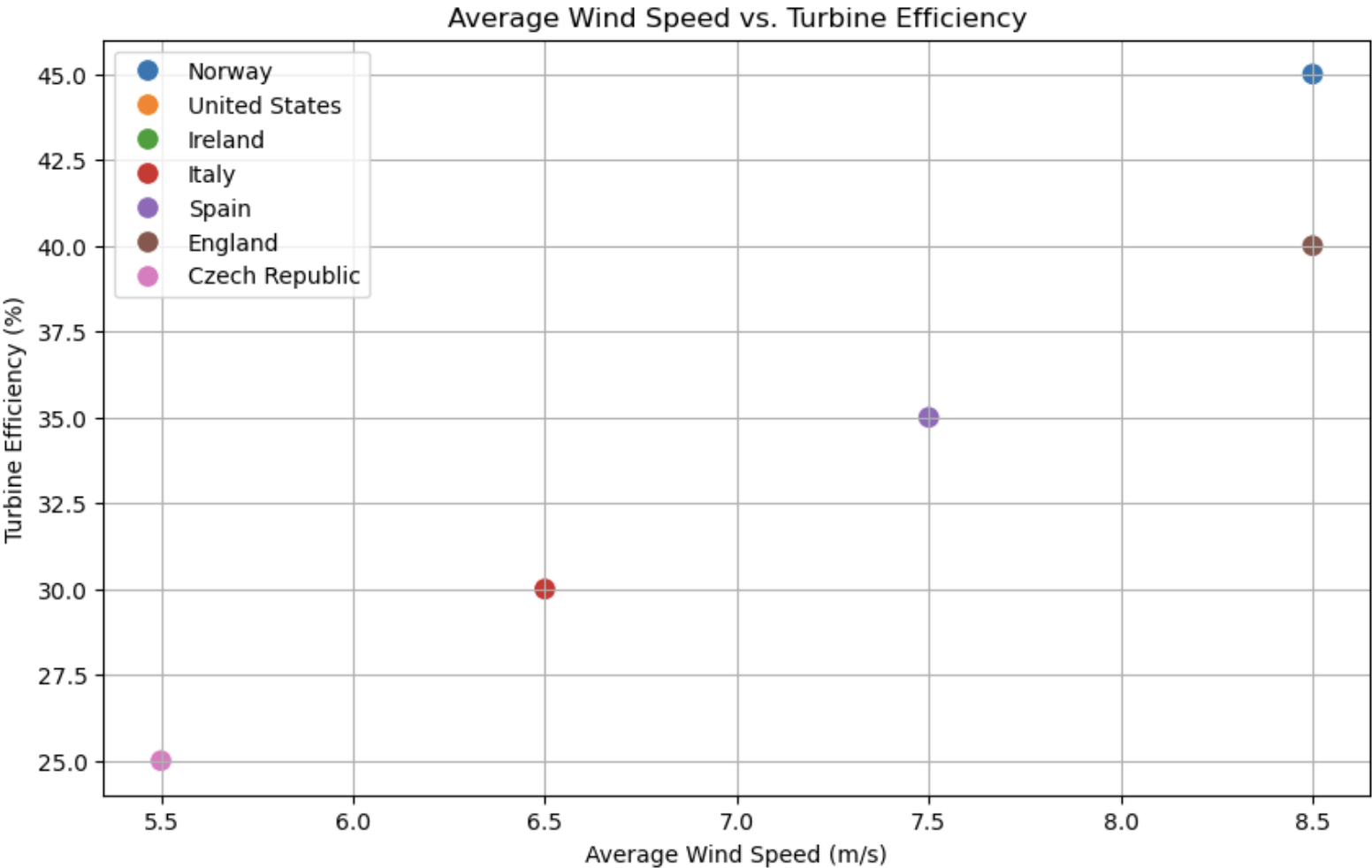

- Model uncertainty in wind turbine output across different regions

- Compare U.S. renewable capacity to Germany, Denmark, and the UK

- Project renewable potential under optimistic and policy-driven scenarios

- Visualize distributions, outliers, and projected capacity curves

- Generated thousands of wind output scenarios using Monte Carlo simulation in Python

- Used numpy.random.normal to represent wind performance variability

- Compared real-world vs. theoretical performance using histograms and overlaid mean curves

- Incorporated region-specific assumptions about capacity, wind strength, and policy ambition

- U.S. performance lags behind Europe due to underutilization and slower growth rate

- Monte Carlo results quantify uncertainty and help guide future energy investment decisions

- Supports policy discussions on renewables by grounding them in statistical simulation

TradeHPC: High-Performance Rust Engine for Predictive Market Modeling

A modular trading engine written in Rust, simulating high-speed financial computation pipelines for backtesting and predictive modeling.

Project Details

This project simulates the backbone of a high-frequency or signal-based trading system, using Rust for performance and system control.

Core Capabilities:

- Models how a real-time engine ingests and processes synthetic market data

- Performs intensive floating-point computation using array simulation logic

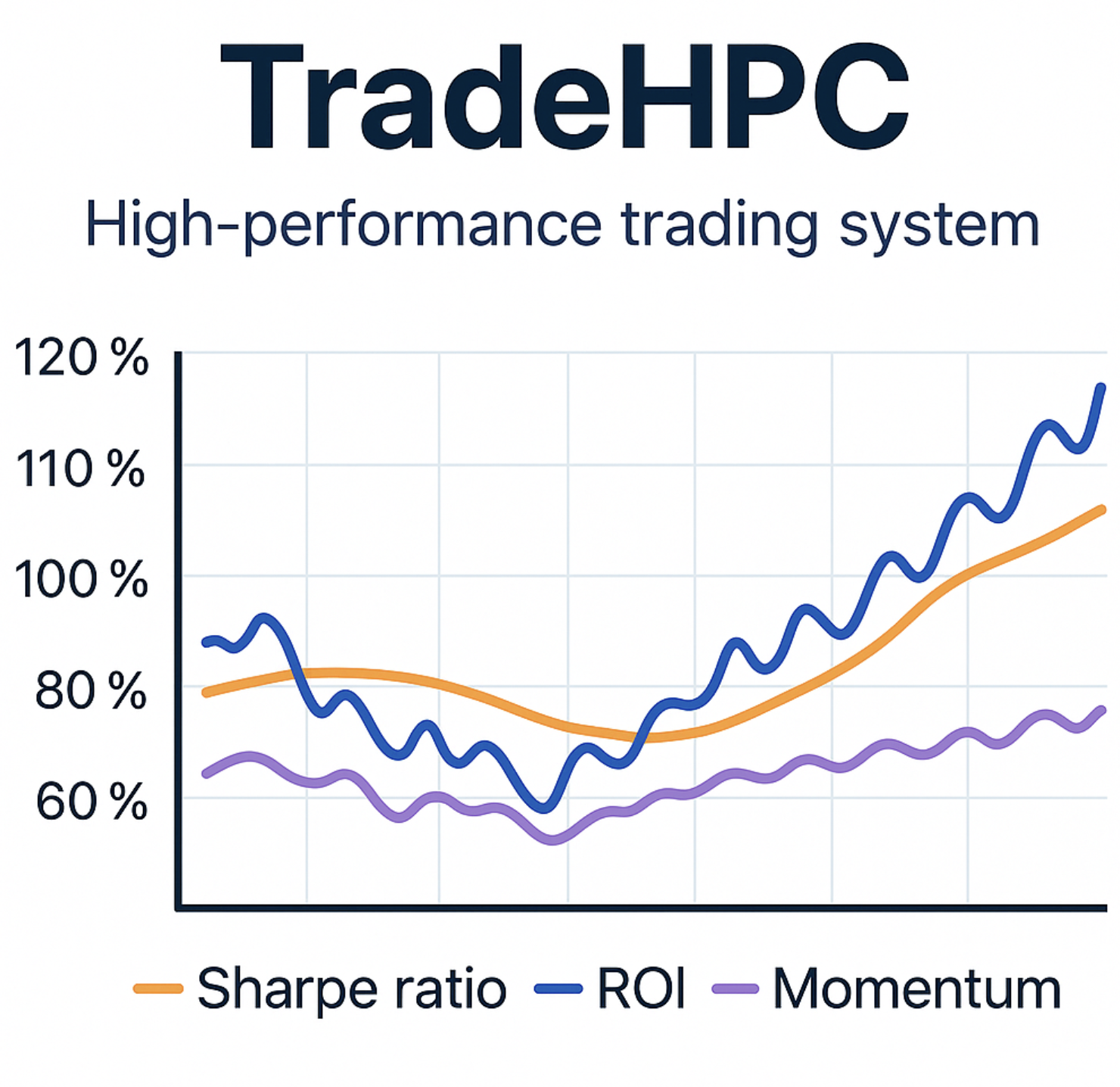

- Prints dynamic output such as simulated Sharpe ratios and momentum scores

- Exposes a clean modular architecture via main.rs, gpu.rs, and mod.rs

- Simulates compute-heavy tasks typical in quantitative research or order execution

- Structured to be extensible — future GPU acceleration and real-time integration possible

- Demonstrates strong command of systems-level performance techniques in Rust